On 21 September 2021, the Dutch government announced the budget and its tax plans for 2022. We have outlined the main plans in this update for you. Please note that the legislative proposals mentioned have yet to be approved by Parliament. They are therefore still subject to amendment.

Corporate income tax rates

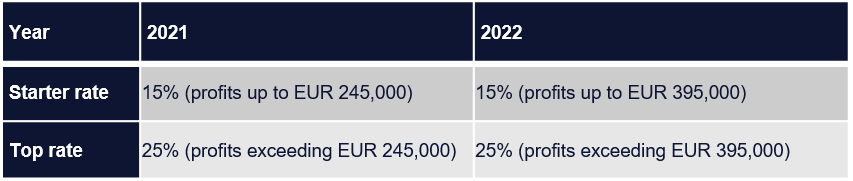

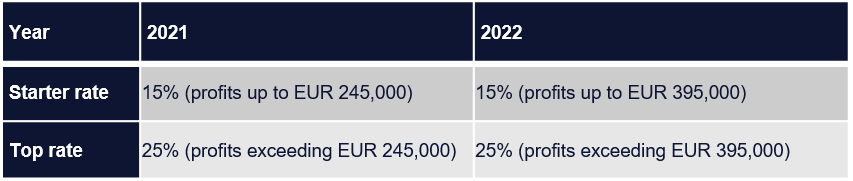

As the government announced in its 2021 Tax Plan, the first income bracket for the starter CIT rate was to be increased to EUR 395,000 in 2022. The 2022 Tax Plan announced yesterday does not provide for any changes. Consequently, the rates will be as follows (with the 2021 rates stated for comparison purposes):

Changes to the CIT loss carry-forward mechanism

From 1 January 2022, losses in excess of EUR 1 million suffered in financial years commencing on or after said date will only be eligible for set-off for up to 50% of the taxable profit. Any remaining losses may be carried forward to any future year. These changes also affect the set-off of losses suffered in previous financial years. Basically, losses suffered in financial years from 1 January 2013 onwards may be carried forward indefinitely. The carry-back period continues to be one year, however. This proposal was first introduced in the 2021 Tax Plan.

Exemption for subsidies received under the Reimbursement Fixed Costs scheme (COVID-19)

A bill will be enacted to the effect that the subsidies received by SMEs under the Reimbursement Fixed Costs [Tegemoetkoming Vaste Lasten (TVL)] scheme will not be considered taxable income for CIT or income tax purposes. In anticipation of the bill being adopted, a policy decision has been taken to regulate this proposal.

Limitation of set-off of dividend tax and gambling tax

In response to the Sofina judgment of the European Court of Justice of 22 November 2018, the government has announced that the set-off of dividend tax and gambling tax (hereinafter: 'withholding taxes') against CIT will be limited as from 1 January 2022, the reason being to remove any conflict with EU legislation.

At present, resident taxpayers for corporate income tax (hereinafter: ‘CIT’) purposes can fully offset withholding taxes. This means, among other things, that there is a full right to a refund of withholding tax withheld if a resident taxpayer does not owe any CIT in a particular year, for example because of a loss suffered. With effect from 1 January 2022, the set-off of withholding tax will be limited up to the amount of CIT due before the set-off in a particular year. Withholding tax that cannot be set off in a year may be carried forward to future years.

In addition to the amendment to the relevant rules, a number of accompanying measures will be taken with effect from 1 January 2022 to regulate the concurrence with the reorganisation facilities and the facility regarding the fiscal unity for CIT purposes.

Bill preventing mismatches when applying the arm’s length principle

Earlier this year, the government held an online public consultation regarding the new Dutch draft legislative proposal that unilaterally addresses certain transfer pricing mismatches to avoid international double non-taxation. Mismatches may result in double non-taxation, for instance in international contexts if a foreign party applies the arm’s length principle differently or not at all, and in a national context if one party to the transaction is not subject to CIT, such as a municipality. Considering this an undesirable situation, the Dutch government now proposes the following key measures.

1. Transactions taking place in financial years starting on or after 1 January 2022:

- Downward adjustments of the Dutch taxable profit as a result of the arm’s length principle will only be granted to the extent that there is a corresponding upward adjustment in the other party's tax base.

- The inclusion on a Dutch balance sheet for CIT purposes of assets or liabilities at fair market value (step-up for assets or step-down for liabilities) will only be accepted by the Dutch Tax Authorities to the extent that a corresponding adjustment is made at the level of the affiliated transferring party.

2. Transactions taking place during financial years starting between 1 July 2019 and 1 January 2022:

- The amount of depreciation to be taken into account on assets acquired from an affiliated party for a price that was not at arm’s length will be limited if the transaction were to fall within the scope of this draft legislation, had this legislation been in force at the time that the transaction took place.

Reverse hybrid entities

In March 2021, the Dutch government held an online consultation on a proposal relating to reverse hybrid entities. This forms part of the Dutch implementation of ATAD2. Following this consultation, the government published a draft bill on 21 September 2021. This bill is intended to enter into effect on 1 January 2022.

Reverse hybrid entities are partnerships that are non-tax transparent in the jurisdiction of incorporation or establishment but are considered tax transparent in the jurisdiction of one or more of the participants. The key points of the bill are:

- Dutch reverse hybrid entities in which at least 50% of the voting rights, capital or profit entitlement is directly or indirectly held by an affiliated participant or a group of investors will be subject to Dutch CIT. Where the income of the reverse hybrid entity is taxable in the country of the participant, a deduction rule applies.

- In line with the CIT treatment of reverse hybrid entities, a Dutch reverse hybrid entity will be considered as the beneficiary and as such become liable to Dutch dividend withholding tax, but only if the dividends relate to participants who consider the reverse hybrid entity to be non-tax transparent.

- Along the same line, a Dutch reverse hybrid entity will become a withholding agent for the interest or royalties paid to that reverse hybrid entity (and, from 1 January 2024, dividends), but only if the payments relate to participants who consider the reverse hybrid entity to be non-tax transparent.

Structural reduction of the landlord levy

The landlord levy will be reduced to compensate housing associations and major private landlords for freezing the rents for social housing. At present, the levy amounts to 0.526% of the tax base. It is proposed to reduce the levy to 0.485% on 1 January 2022. In addition, the caretaker cabinet proposes to make it possible to change the tax reduction rate on a monthly basis to prevent the available budgets from being exceeded or at least minimise such excess. We should add that an alternative bill has been mooted by the left-wing parties, ‘PvdA’ and ‘GroenLinks’, calling for the total abolition of the landlord levy.

No real estate transfer tax due on repurchase of property from private individuals

With effect from 1 January 2022, housing associations or project developers that repurchase from private individuals homes earlier sold to these individuals subject to specific conditions will no longer be subject to real estate transfer tax. The current real estate transfer tax rate in such cases is 8%. More details on this particular measure will be provided in our newsletter for housing associations.

Temporary increase fixed exemption work-related expenses scheme now enshrined in law

The fixed exemption in the work-related expenses scheme amounts to 3% up to an amount of EUR 400,000 of the payroll for tax purposes. The percentage used to be 1.7%, but was raised to 3% in 2020 and 2021 due to the COVID-19 pandemic. This gives employers more scope to give their employees additional allowances and benefits in kind. With the proposal for the 2022 Tax Plan, the temporary increase for 2021 will now be enshrined in law. In 2022, the increase will no longer apply, meaning that the discretionary margin up to EUR 400,000 of the wage bill will revert to 1.7%, and to 1.18% above that amount.

Tax-free allowance for working from home costs

Announced earlier, this proposal provides for a targeted exemption for reimbursement of costs related to working from home. The maximum reimbursement for home-working costs has been set at EUR 2 per day worked at home. The reimbursement covers the extra costs of water and electricity consumption, heating, coffee, tea and toilet paper. The exemption adds to the current crop of tax-exempt allowances for specific costs related to working from home, such as the costs of an internet connection and home office furniture and equipment.

If the employee works from home for a part of the day and at the fixed place of work for the rest of the day, the employer cannot apply both the exemption for a home-working allowance and the exemption for commuting costs (to the fixed place of work). In that situation, it is up to the employer to decide which exemption to apply. A restriction also applies if, on a “hybrid” day as described above, the employee commutes to the fixed place of work and the commuting expenses (whether a company car or a public transport pass) are reimbursed by the employer. The latter cannot apply the tax exemption for home-working costs in that case.

The proposal provides for a fixed - monthly - allowance for working from home costs. To this end, the government proposes the introduction of a scheme similar to the current fixed commuting expenses allowance (‘128-days rule’). An adjustment to the current fixed commuting allowance will make a pro-rata application of the allowance possible to structural (part-time) home-working arrangements agreed between employers and employees. In situations where such arrangements apply, a combination allowance based on the division between home and office may be applied. An incidental change in the distribution of days need not lead to an adjustment of the fixed allowances. However, a structural change to the agreed work pattern does necessitate such adjustment.

The amount of EUR 2 per home-working day is subject to annual index-linking.

Postponing taxation on stock option income

Affecting all employers, this proposal concerns shares obtained on exercising option rights subject to legal or contractual restrictions on alienation. If the shares are immediately marketable at the moment the options are exercised, the taxation date will be the same as under current legislation and nothing will change.

The government now proposes to shift the taxation date to the moment the employee can trade the shares obtained upon exercise, at which time liquid assets become available for paying the taxes due. Tax will be levied over the difference between the value of the shares at that moment and the price at the time of acquisition. A rebate on the value of the shares may be applied. In order to avoid an overly long tax deferral, additional rules have been put in place. For listed companies, the legal sales restrictions (for notional taxation purposes) will be deemed to expire no later than five years after the exercise of the option rights, or no later than five years after the IPO. Benefits, such as dividends, paid on the shares up to the time of taxation are taxed as salary.

Employees can choose to be taxed immediately upon acquisition rather than at the later moment when the shares become marketable. They must, however, declare this choice in writing to the withholding agent not later than at the time of exercise.

If the proposal is adopted, the stock option rights facility for start-up companies with an R&D statement will be abolished with effect from 1 January 2022.

Conclusion

As the country is still being governed by a caretaker cabinet, we expect the debate on the above bills and proposals to continue, so much so that amendments may be put forward and approved before the bills are adopted and enacted.

Obviously, we will keep you posted of such developments.

On 21 September 2021, the Dutch government announced the budget and its tax plans for 2022. We have outlined the main plans in this update for you. Please note that the legislative proposals mentioned have yet to be approved by Parliament. They are therefore still subject to amendment.

Corporate income tax rates

As the government announced in its 2021 Tax Plan, the first income bracket for the starter CIT rate was to be increased to EUR 395,000 in 2022. The 2022 Tax Plan announced yesterday does not provide for any changes. Consequently, the rates will be as follows (with the 2021 rates stated for comparison purposes):

Changes to the CIT loss carry-forward mechanism

From 1 January 2022, losses in excess of EUR 1 million suffered in financial years commencing on or after said date will only be eligible for set-off for up to 50% of the taxable profit. Any remaining losses may be carried forward to any future year. These changes also affect the set-off of losses suffered in previous financial years. Basically, losses suffered in financial years from 1 January 2013 onwards may be carried forward indefinitely. The carry-back period continues to be one year, however. This proposal was first introduced in the 2021 Tax Plan.

Exemption for subsidies received under the Reimbursement Fixed Costs scheme (COVID-19)

A bill will be enacted to the effect that the subsidies received by SMEs under the Reimbursement Fixed Costs [Tegemoetkoming Vaste Lasten (TVL)] scheme will not be considered taxable income for CIT or income tax purposes. In anticipation of the bill being adopted, a policy decision has been taken to regulate this proposal.

Limitation of set-off of dividend tax and gambling tax

In response to the Sofina judgment of the European Court of Justice of 22 November 2018, the government has announced that the set-off of dividend tax and gambling tax (hereinafter: 'withholding taxes') against CIT will be limited as from 1 January 2022, the reason being to remove any conflict with EU legislation.

At present, resident taxpayers for corporate income tax (hereinafter: ‘CIT’) purposes can fully offset withholding taxes. This means, among other things, that there is a full right to a refund of withholding tax withheld if a resident taxpayer does not owe any CIT in a particular year, for example because of a loss suffered. With effect from 1 January 2022, the set-off of withholding tax will be limited up to the amount of CIT due before the set-off in a particular year. Withholding tax that cannot be set off in a year may be carried forward to future years.

In addition to the amendment to the relevant rules, a number of accompanying measures will be taken with effect from 1 January 2022 to regulate the concurrence with the reorganisation facilities and the facility regarding the fiscal unity for CIT purposes.

Bill preventing mismatches when applying the arm’s length principle

Earlier this year, the government held an online public consultation regarding the new Dutch draft legislative proposal that unilaterally addresses certain transfer pricing mismatches to avoid international double non-taxation. Mismatches may result in double non-taxation, for instance in international contexts if a foreign party applies the arm’s length principle differently or not at all, and in a national context if one party to the transaction is not subject to CIT, such as a municipality. Considering this an undesirable situation, the Dutch government now proposes the following key measures.

1. Transactions taking place in financial years starting on or after 1 January 2022:

- Downward adjustments of the Dutch taxable profit as a result of the arm’s length principle will only be granted to the extent that there is a corresponding upward adjustment in the other party's tax base.

- The inclusion on a Dutch balance sheet for CIT purposes of assets or liabilities at fair market value (step-up for assets or step-down for liabilities) will only be accepted by the Dutch Tax Authorities to the extent that a corresponding adjustment is made at the level of the affiliated transferring party.

2. Transactions taking place during financial years starting between 1 July 2019 and 1 January 2022:

- The amount of depreciation to be taken into account on assets acquired from an affiliated party for a price that was not at arm’s length will be limited if the transaction were to fall within the scope of this draft legislation, had this legislation been in force at the time that the transaction took place.

Reverse hybrid entities

In March 2021, the Dutch government held an online consultation on a proposal relating to reverse hybrid entities. This forms part of the Dutch implementation of ATAD2. Following this consultation, the government published a draft bill on 21 September 2021. This bill is intended to enter into effect on 1 January 2022.

Reverse hybrid entities are partnerships that are non-tax transparent in the jurisdiction of incorporation or establishment but are considered tax transparent in the jurisdiction of one or more of the participants. The key points of the bill are:

- Dutch reverse hybrid entities in which at least 50% of the voting rights, capital or profit entitlement is directly or indirectly held by an affiliated participant or a group of investors will be subject to Dutch CIT. Where the income of the reverse hybrid entity is taxable in the country of the participant, a deduction rule applies.

- In line with the CIT treatment of reverse hybrid entities, a Dutch reverse hybrid entity will be considered as the beneficiary and as such become liable to Dutch dividend withholding tax, but only if the dividends relate to participants who consider the reverse hybrid entity to be non-tax transparent.

- Along the same line, a Dutch reverse hybrid entity will become a withholding agent for the interest or royalties paid to that reverse hybrid entity (and, from 1 January 2024, dividends), but only if the payments relate to participants who consider the reverse hybrid entity to be non-tax transparent.

Structural reduction of the landlord levy

The landlord levy will be reduced to compensate housing associations and major private landlords for freezing the rents for social housing. At present, the levy amounts to 0.526% of the tax base. It is proposed to reduce the levy to 0.485% on 1 January 2022. In addition, the caretaker cabinet proposes to make it possible to change the tax reduction rate on a monthly basis to prevent the available budgets from being exceeded or at least minimise such excess. We should add that an alternative bill has been mooted by the left-wing parties, ‘PvdA’ and ‘GroenLinks’, calling for the total abolition of the landlord levy.

No real estate transfer tax due on repurchase of property from private individuals

With effect from 1 January 2022, housing associations or project developers that repurchase from private individuals homes earlier sold to these individuals subject to specific conditions will no longer be subject to real estate transfer tax. The current real estate transfer tax rate in such cases is 8%. More details on this particular measure will be provided in our newsletter for housing associations.

Temporary increase fixed exemption work-related expenses scheme now enshrined in law

The fixed exemption in the work-related expenses scheme amounts to 3% up to an amount of EUR 400,000 of the payroll for tax purposes. The percentage used to be 1.7%, but was raised to 3% in 2020 and 2021 due to the COVID-19 pandemic. This gives employers more scope to give their employees additional allowances and benefits in kind. With the proposal for the 2022 Tax Plan, the temporary increase for 2021 will now be enshrined in law. In 2022, the increase will no longer apply, meaning that the discretionary margin up to EUR 400,000 of the wage bill will revert to 1.7%, and to 1.18% above that amount.

Tax-free allowance for working from home costs

Announced earlier, this proposal provides for a targeted exemption for reimbursement of costs related to working from home. The maximum reimbursement for home-working costs has been set at EUR 2 per day worked at home. The reimbursement covers the extra costs of water and electricity consumption, heating, coffee, tea and toilet paper. The exemption adds to the current crop of tax-exempt allowances for specific costs related to working from home, such as the costs of an internet connection and home office furniture and equipment.

If the employee works from home for a part of the day and at the fixed place of work for the rest of the day, the employer cannot apply both the exemption for a home-working allowance and the exemption for commuting costs (to the fixed place of work). In that situation, it is up to the employer to decide which exemption to apply. A restriction also applies if, on a “hybrid” day as described above, the employee commutes to the fixed place of work and the commuting expenses (whether a company car or a public transport pass) are reimbursed by the employer. The latter cannot apply the tax exemption for home-working costs in that case.

The proposal provides for a fixed - monthly - allowance for working from home costs. To this end, the government proposes the introduction of a scheme similar to the current fixed commuting expenses allowance (‘128-days rule’). An adjustment to the current fixed commuting allowance will make a pro-rata application of the allowance possible to structural (part-time) home-working arrangements agreed between employers and employees. In situations where such arrangements apply, a combination allowance based on the division between home and office may be applied. An incidental change in the distribution of days need not lead to an adjustment of the fixed allowances. However, a structural change to the agreed work pattern does necessitate such adjustment.

The amount of EUR 2 per home-working day is subject to annual index-linking.

Postponing taxation on stock option income

Affecting all employers, this proposal concerns shares obtained on exercising option rights subject to legal or contractual restrictions on alienation. If the shares are immediately marketable at the moment the options are exercised, the taxation date will be the same as under current legislation and nothing will change.

The government now proposes to shift the taxation date to the moment the employee can trade the shares obtained upon exercise, at which time liquid assets become available for paying the taxes due. Tax will be levied over the difference between the value of the shares at that moment and the price at the time of acquisition. A rebate on the value of the shares may be applied. In order to avoid an overly long tax deferral, additional rules have been put in place. For listed companies, the legal sales restrictions (for notional taxation purposes) will be deemed to expire no later than five years after the exercise of the option rights, or no later than five years after the IPO. Benefits, such as dividends, paid on the shares up to the time of taxation are taxed as salary.

Employees can choose to be taxed immediately upon acquisition rather than at the later moment when the shares become marketable. They must, however, declare this choice in writing to the withholding agent not later than at the time of exercise.

If the proposal is adopted, the stock option rights facility for start-up companies with an R&D statement will be abolished with effect from 1 January 2022.

Conclusion

As the country is still being governed by a caretaker cabinet, we expect the debate on the above bills and proposals to continue, so much so that amendments may be put forward and approved before the bills are adopted and enacted.

Obviously, we will keep you posted of such developments.